Call center software can be a game-changer for insurance providers, who are regularly swamped with a high volume of inbound and outbound calls. Adopting the right solution can boost efficiency and customer satisfaction and ensure compliance with industry regulations.

How Insurance Providers Can Benefit From Call Center Software

Insurance companies can benefit from call center software in several distinct ways, including improved customer experience, boosted agent efficiency, strategic decision-making, and cost reduction.

Unified customer experience

A unified customer experience creates consistent and powerful brand interactions for customers across multiple channels and touchpoints within the customer lifecycle. This is made possible through several features:

Streamlined interactions

Interactive voice response (IVR) systems offer self-service options for basic customer inquiries like return policy details or bill payments. By preventing non-complex calls from reaching agents, wait times for all inbound callers can be reduced.

Call routing and automatic call distribution efficiently direct customers to the most qualified agent based on their needs, reducing transfers and improving resolution times. Finally, effortless call transfers between in-office staff, corporate teams, and call center agents can connect customers with someone who can help them quickly.

Personalized service

Call center software can integrate with customer relationship management (CRM) systems to provide agents with a complete view of each customer’s policy, claim history, and support records. This makes it easier for agents to offer personalized interactions, more quickly resolve customers’ issues, and identify opportunities to upsell.

Omnichannel support

Using call center software allows a company to handle inquiries across multiple channels, including phone, email, web chat, and SMS messaging, so customers can choose how they get in touch. Providing multiple support options can increase customer satisfaction and loyalty rates because it’s always best to connect with customers on the platform that’s most convenient for them.

Improved agent productivity

Improved call center agent productivity means agents are able to answer more calls, resolve additional customer concerns, and deliver higher-quality customer support.

Call center software for insurance companies can improve agent productivity in several ways:

Automated workflows

Repetitive tasks like data entry or the distribution of standard policy updates can be streamlined, freeing up agents to focus on more complex customer interactions.

Call recording

Automatic and on-demand call recording and transcription make it easier for managers to review past interactions for agent performance reviews. These recorded calls can help managers identify training opportunities, which in turn improves agent skills, knowledge, and consistency.

Whether you choose on-demand or automatic call recording, remember to pause recordings when collecting sensitive customer information if required by industry regulations.

Real-time coaching and monitoring

Supervisors can monitor calls in real time to offer guidance or even intervene if needed. This can ensure quality service delivery.

Agent assist features also remind agents to read verbal disclosures, confirm customer consent, and guide customers through complex insurance processes by following call scripts and templates. While these features are essential for new or in-training agents, all team members can benefit from them.

Performance metrics and reporting

Call center software provides valuable data on agent performance, call volume, and resolution rates. Schedule more staff for hours when peak call volumes are expected, and use data analysis to discover opportunities for targeted improvements.

Data-driven decision-making

Analytics from call center software can help you track customer interactions, identify trends, and reveal opportunities for improvement. By better understanding customer behavior and pain points, agencies can tailor product offerings and service approaches to best serve their target audience.

Reduced costs

Cloud-based insurance call center software can reduce costs in several ways, including the following:

- Improved first-call resolution rates minimize the need for follow-up calls, saving time and resources.

- Capturing and displaying all customer information across multiple channels increases productivity.

- Self-service options deflect simple inquiries, reducing agent workloads and associated costs.

- Data-driven insights enable efficient resource allocation and targeted marketing campaigns.

Related: Call Center for Insurance Agencies: Must-Have Features

What Providers Should Look for When Choosing a Call Center Vendor

For insurance companies choosing a call center provider, certain features and functionalities should be prioritized.

Features

Look for VoIP service providers that offer features designed to enhance the customer experience.

Some examples include:

- Interactive Voice Response (IVR)

- Omnichannel support, including email, SMS messaging, and online chat

- Advanced call management

- Smart call routing, including using auto-attendants and skills-based routing

- CRM system integrations

- Voice, video, email, web chat, and SMS messaging support

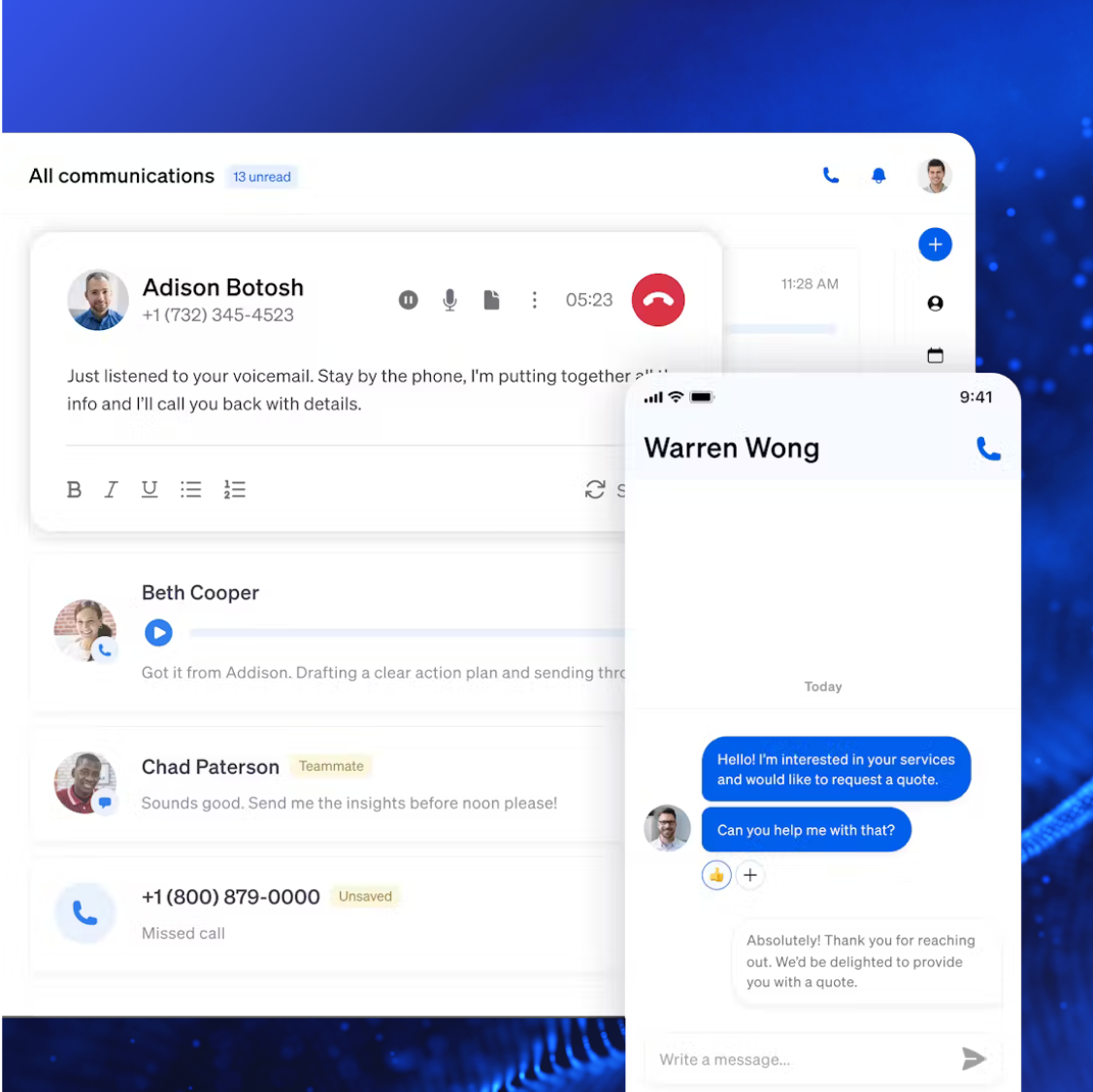

Mobile- and desktop-ready

With an increasing number of support agents now working remotely, it’s important to ensure your team can help customers from home and out in the field just as effectively as they could from the office.

Call center software should be both desktop- and mobile-friendly, with the option to make outbound calls, receive inbound calls, access customer data, and send photos and updates to the team. Most cloud-based contact center software allows agents to access the system on their desktop or from a mobile app on their phone.

Scalability and flexibility

Insurance companies can scale quickly, so be sure to choose a solution that can adapt to your agency’s projected long-term growth. Having the flexibility to scale both up and down in terms of different plans, usage, and features is important.

To scale effectively, choose a solution that integrates with your existing tech stack, including your CRM.

Reporting and analytics

Look for call center software with robust reporting tools that provide valuable customer and agent performance insights.

Track call volume, agent performance, and key customer service metrics like customer satisfaction, first call resolution rates, Net Promoter Score, and Customer Effort Score.

Ease of use

Onboarding, implementation, and adoption should be as easy as possible, so choose a solution with a user-friendly interface. It should be simple for agents to make and receive calls, access customer data, and store customer information.

For call center software, ease of use also includes the need for high call quality and reliable service. For instance, Hancock Insurance came to Nextiva after experiencing poor call quality, service reliability, and customer support.

Since working with Nextiva, the company has provided better customer service to its customers across the US and Canada.

“The entire team is happy with Nextiva. We receive great service, and the call quality has improved significantly, plus we can call Canada cheaply! Our potential customers are searching online, and then they call in. With Nextiva, we’re all much more confident in the reliability of our phone service.”

~Cory Wormell, Insurance Agent

Support and training

Choose call center software that has dedicated customer support, ideally with the option of assistance during onboarding. Reliable agent training resources and vendor support can ensure smooth implementation.

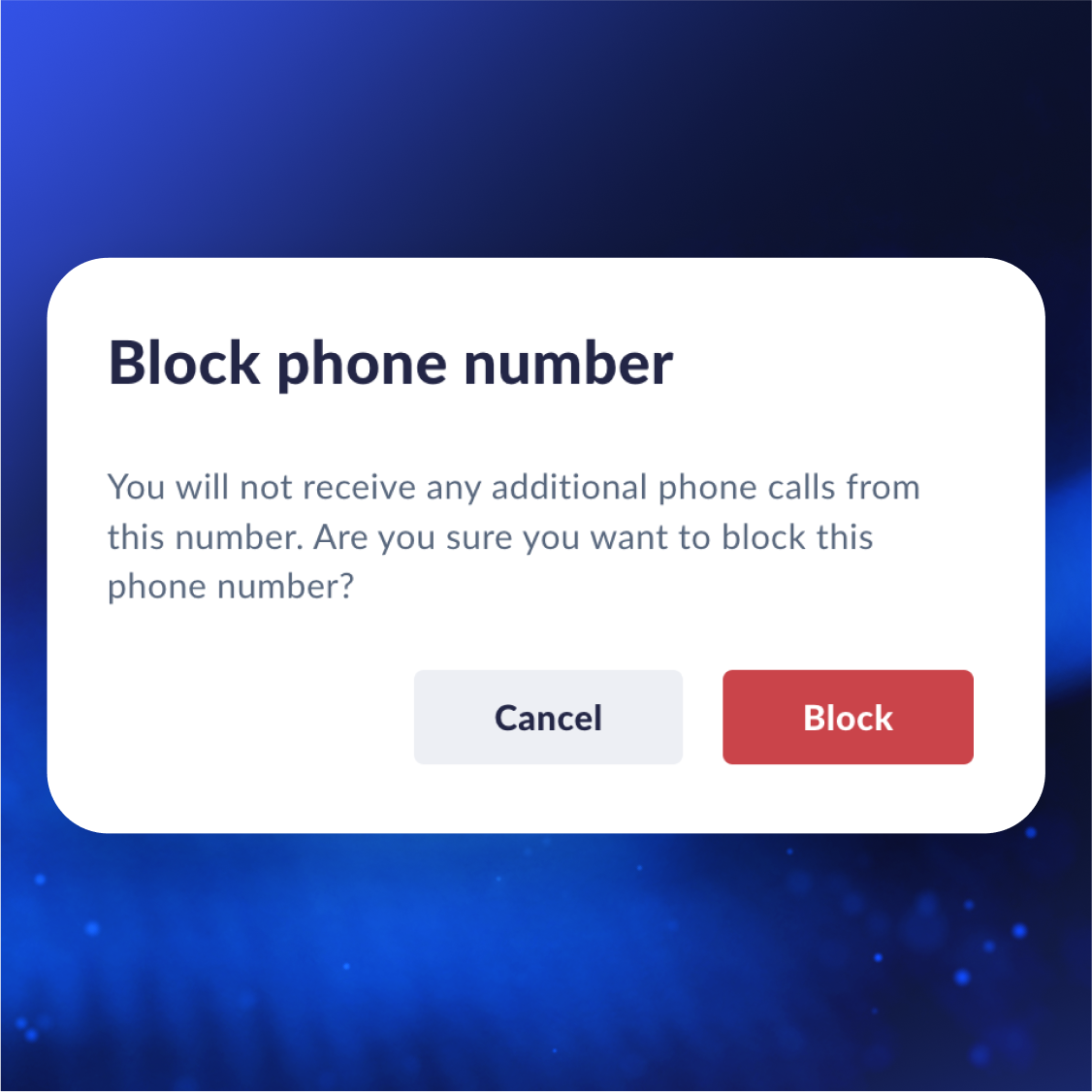

Security and compliance

Security and compliance features for call centers are a critical consideration, but they’re particularly important for insurance businesses.

Health insurance agencies, for example, must abide by the HIPAA. Choosing HIPAA-compliant call center solutions can help ensure your organization is compliant. Nextiva allows agents to pause calls when taking sensitive customer information and disables the automated voicemail-to-email transcript feature.

Security features, including data encryption, two-factor authentication, and access management functionality, are an integral part of maintaining compliance.

Insurance Providers Count on Nextiva for Their Call Center Solutions

Choosing the right service provider is essential, which is why so many insurance companies have come to Nextiva.

Nextiva’s insurance solutions offer the following features:

- Advanced call management

- Intelligent routing, including skills-based call routing

- Transparent and affordable pricing

- Reliable service, with 99.999% uptime

- 24/7 customer support, with some plans including dedicated account onboarding

- CRM integrations

- Industry-compliant services, including HIPAA compliance

- Intuitive dashboard and interface

- Advanced call analytics

- Security features, including data encryption that aligns with industry standards

UCPM — a national environmental insurance wholesaler — has a team spread across the country, so securing a strong phone system for internal and external communications was essential. The company chose Nextiva for our high service uptimes, consistent call quality, and exceptional, easy-to-use software. Nextiva’s dedicated training and 24/7 support staff have also kept the team happy.

“Our team didn’t require a lot of training, but those who received it found it simple. They were trained by Nextiva and passed the information along. We got a great deal on our phones and decided to use softphones for our tech team. We were up and running quickly without any issues!”

~Bart Jarman, Executive Vice President

The insurance industry is complex, and it relies heavily on direct agent-to-client interaction. Insurance contact center solutions can improve the customer experience (and customer engagement) while boosting agent productivity, reducing overall costs, and ensuring compliance with industry regulations.

Improve your bottom line.

Nextiva helps insurance companies increase renewals with one platform for efficient, responsive conversations.

Customer Experience

Customer Experience