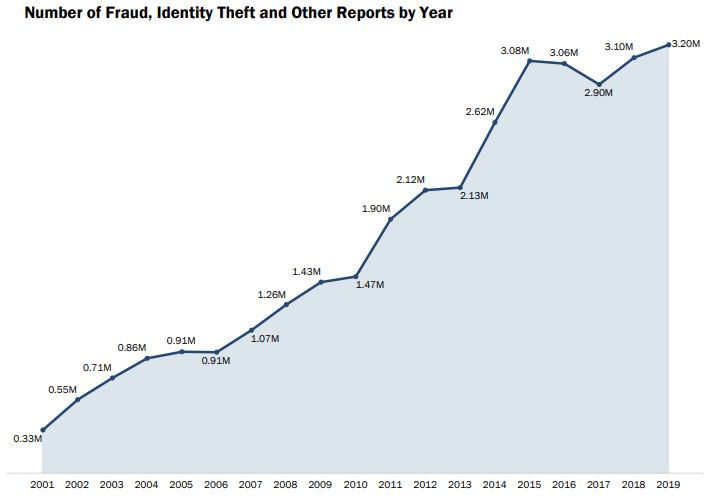

Last year, over 821,000 Americans were scammed over the phone resulting in a loss of $1.3 billion. Not only are common phone scams on the rise, but they’re also at an all-time high.

This guide will share the top phone scams and how you can fight back.

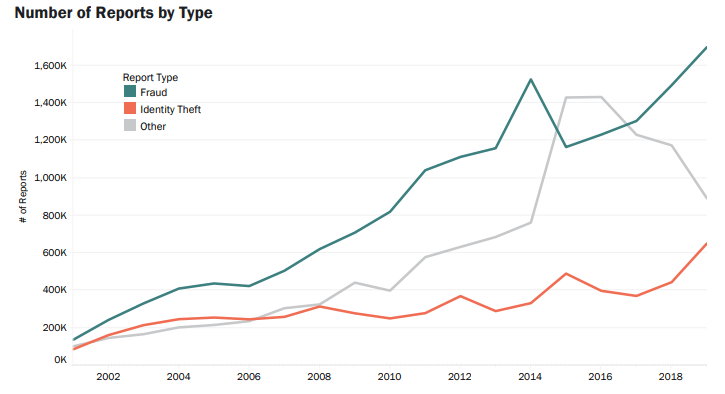

Source: FTC

Source: FTC

Millions of business owners and entrepreneurs serve customers using innovative, cloud-based phone systems every day. However, criminals can use this technology against everyday consumers and businesses.

These phone scams go well beyond annoying robocalls. Out of all the reported scams with monetary losses, 74% of victims were contacted using the phone.

Ready to jump right in? Here’s the list of scams:

- IRS Scams

- Grandparent Scams

- Fake Charity Scams

- Fake Customer Service “Help”

- Bank Scams

- Medicare & Insurance Scams

- Travel Scams

- Free Gift Scams

- Lottery & Sweepstakes Scams

- Fake Customer Scams

- Craigslist Verification Scams

- COVID-19/Coronavirus Scams

- Government Stimulus Check Scams

What is a Phone Scam?

A phone scam is a fraudulent phone call that uses deception to take advantage of a person. Typically, a phone scam enlists the victim in sending money or prepaid gift cards to the scammer.

There are so many different kinds of phone scams out there, and it can be hard to track all of them. However, they generally operate on these principles.

These are tell-tale signs that you might be dealing with a scam:

- Urgent: A scammer wants you to act right now, so you can’t find out they’re lying to you.

- Untraceable Payments: They want you to pay them using wire transfers, prepaid cards, or other gift cards.

- Requests for Personal Information: They might have limited information about you but want to confirm it over the phone, such as your name, social security number, and bank accounts. This is known as phishing.

- Unsolicited Help or Free Gifts: They offer to help you didn’t ask for or free gifts you didn’t sign up for.

- Aggressive Behavior: The scammer may become aggressive, subjecting you to threats of being arrested or sued.

Newly released data from the Federal Trade Commission (FTC) shows that the number of victims and financial losses increased across the board. Most of these scams are classified as an imposter scam.

What’s an imposter scam?

Imposter Scam:

“Someone pretends to be a trusted person to get consumers to send money or give personal information. Examples include scammers claiming to work for or be affiliated with a government agency; scammers posing as a friend or relative with an emergency need for money; scammers posing as a romantic interest; scammers claiming to be a computer technician offering technical support; and scammers claiming to be affiliated with a private entity (e.g., a charity or company).”

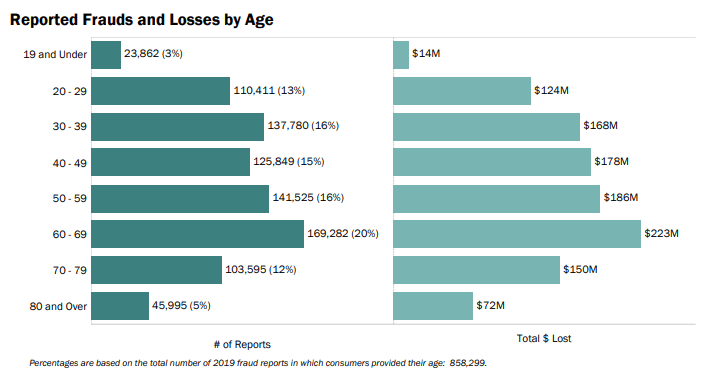

Largely senior citizens are the most targeted, but we’ve found that all ages and demographics are vulnerable to being scammed over the phone. Last year, 47% of all reported fraud incidents were among people younger than 50 years old.

Related: What Is STIR/SHAKEN & How Does It Help Businesses?

Protect Yourself From These Top Phone Scams

1. IRS Tax Scams

Perhaps the most dangerous of phone scams, IRS scams pick up before tax time. That’s when Americans are most vulnerable as they worry about their taxes.

Typical IRS scams involve the scammer contacting a taxpayer about a problem with their taxes. The most common scams say the victim owes back taxes that must be paid immediately. They’ll threaten further penalties or even jail.

The biggest tool a scammer uses in a common phone scam is fear. Never give in to a scary-sounding situation. It’s all fake.

In order to solve the problem, the taxpayer must make a payment immediately, often by wire transfer or another untraceable method. The taxpayer feels understandably worried.

IRS scams often use spoofing technology to fool you. Calls look like they’re coming from “credible” area codes or have misleading names on the caller ID.

A common form of tax fraud can happen when someone uses your social security number to report their income. It works when someone falsely provides an employer with your SSN. What could happen? You could be flagged for underreporting — even though you had no idea it happened — and you’ll need to clear your name with the IRS. You would have received official correspondence via the U.S. Postal Service if this happened to you.

Con artists may also use this common phone scam to gain credibility by knowing personal details about you, such as all or part of your social security number. They will have done their homework.

The easiest way to avoid an IRS phone scam is to remember that the IRS will contact you via mail. You can also call the IRS yourself to confirm any story.

2. Grandparent Scams

Grandparent scams are particularly cruel. They prey on well-meaning people and take advantage of their love for their grandchildren.

Here’s how they work. The scam artist contacts the grandparent and tells them their grandchild is in trouble and needs their help urgently. Some con artists even pretend to be the grandchild themselves.

Common scenarios include things like being in jail or being in an accident. But whatever the case, the child needs money, and they need it fast.

Often, the caller has personal information, which makes their claims credible. It’s easy enough to find information on social media. People routinely announce where they live and where they’re headed on vacation.

Some criminals will go even further to research and find targets. Other times the callers are simply making random calls, hoping to find a mark.

AARP warns seniors to beware of any calls from family members asking for money. Always take time to verify the information with other family members before sending any money.

And just because you aren’t a grandparent doesn’t mean you aren’t at risk for this type of phone scam. Fraudsters can target anyone in this way.

3. Fake Charity Scams

Charitable outpourings in the wake of natural disasters are heartwarming. But phone scammers are standing by, waiting to take advantage of your generosity and kindness.

Fake charity scams call people asking for money on behalf of a good cause or in response to a national disaster. The situation provides built-in urgency. You have to act fast. They might even claim they are from the Red Cross thanking you for your recent donation.

But the donations don’t actually go to charity. Instead, the criminals make off with the cash. This type of scam is terrible because fraudsters take your money, and the people who truly need help never get it.

To protect yourself, always research any organization you’re considering working with. True organizations will be happy to provide you with information and set your mind at ease. If they’re reluctant to do so, that’s a red flag. Hang up and report them.

Always be suspicious of anyone calling you to ask for money for a “good” cause. Although there are plenty of reputable organizations, there are also plenty of dishonest people out there looking to take advantage.

4. Fake Customer Service “Help”

Fake customer service scams contact victims and offer various types of help and tech support.

The scammer often claims to be calling from a large, reputable tech company such as Microsoft or Apple. Then they alert you to a problem on your computer or with your accounts. Scammers might even purchase Google Ads to have you call their phone number instead.

Once you’re worried sick, they’ll offer to help you solve the problem. They may claim to need your password in order to help. You should never give your password to anyone. Even someone you trust.

Other scammers request remote access to your computer. Then they install a virus or malware. Finally, they’ll offer you a solution you have to pay for.

Not only do they steal your money, but now your computer really does have a problem. The virus they plant can corrupt your data, and you may end up paying much more to restore it.

The calls may even seem to come from a legitimate outbound call center. Microsoft states that its technical support representatives will never initiate contact with a user. Avoid this common phone scam by contacting the manufacturer directly and getting their official phone number by visiting their website.

5. Bank Scams

We’re all vulnerable when it comes to money. That means anyone with a bank account, credit card, or debit card is at risk for bank scams.

The con artist contacts the victim claiming to be calling from the victim’s bank about a problem with their account. Bank scams may even initiate contact via cell phone with a text message, alerting you to suspicious activity on your account.

Because credit card fraud is rampant, most people want to take care of it quickly. And many banks do send text alerts about account activity. This makes consumers especially vulnerable.

But they aren’t trying to help you. It’s a phishing scam. Once they have you on the phone, they’ll ask you to provide personal account information or credit card numbers.

To avoid being scammed, never divulge personal information to anyone. Your real bank will already know your credit card information and account numbers. And they never need your password or PIN.

Fact: According to Aura, a top identity theft protection service, 1.9K data breaches in 2020 exposed over 37 billion records.

6. Medicare & Insurance Scams

Medicare and insurance scams also prey on the most vulnerable. Scammers target seniors and sick people, often with serious results.

Fraudsters contact people with a variety of Medicare & insurance scams. They may offer to enroll you online. This is especially common during rollout or open enrollment periods.

Another common scam is asking if you’ve received your new card or if you’d like them to activate it. Or they say there’s a problem with your card. When this is the case, they’ll often use scare tactics such as saying you may lose your benefits if you don’t act now.

No matter what scenario they use, this scam aims to get personal medical and financial information or scam you into paying for services you don’t need or don’t exist.

Medicare.gov cautions people to guard their Medicare number like a credit card number. They won’t contact you for your number or try to sell you something.

7. Travel Scams

Travel scammers contact people and offer free vacations and other travel-related deals and prizes. Often the deals are limited time and too good to pass up.

Sometimes the deals they’re offering don’t exist at all. And other times, the deals aren’t what they claim to be. For example, you may pay for the right to book a trip, but that trip is already full.

Or you get a free trip but have to listen to a high-pressure timeshare sales pitch. These are particularly dangerous because it puts you at risk of buying a timeshare.

Timeshares last forever and are difficult to cancel once you buy one. And they can cost thousands and thousands of dollars. In fact, people often find themselves paying thousands of dollars just to get rid of their timeshare!

The easiest way to not fall for a travel scam is always to say no. Even if that means passing up a seemingly amazing deal. If it sounds too good to be true, it probably is.

However, if you are truly interested in a deal, ask for details in writing. Scammers are unlikely to provide it, or if they do, the scam will be revealed.

8. Free Gift Scams

Travel scams are part of a larger classification of free gift scams. There’s a whole universe of free gift scams out there, and they’re all bad news.

Of course, there are many legitimate freebies in exchange for your email address or in addition to a purchase you make. Those are not scams, so long as you are presented with the terms and conditions and it’s a fair exchange of value for your information.

But free gift scams aren’t just after your email address. They don’t want to send you a newsletter. They want you to pay for something without value or give up dangerous personal information.

For example, in order to get your free gift, you may have to give them your card number or home address. Or they may ask you to pay a small tax or fee (e.g., shipping and handling) to receive your item. And you’ll be lucky if that small fee is all they charge you.

Free gift scams often offer high-value items to convince you to go against your better judgment and give them your information. But remember, if you’re not paying for it, you’re the product.

9. Lottery & Sweepstakes Scams

You may already be a winner. But when you’re the victim of a lottery scam, the only winner is the scammer.

Lottery and sweepstakes scams are nothing new. It’s the oldest scam in the book. Scammers contact you saying you’ve won a prize. And then they ask you for personal information or other payments in order to claim this amazing prize.

Surprise! There’s no prize waiting for you.

It’s easy to see why people fall for these scams. Who doesn’t fantasize about winning big? And that’s what these criminals are counting on.

One common scheme claims to be calling from foreign lotteries. They either offer you a chance to buy tickets or say you’ve already won.

Once you’re interested, they may ask you to pay a small fee or tax to claim your prize. They’ll try to get you to reveal personal information in the process. And then they can use that information to steal even more from you.

These super common phone scams are illegal but often originate from outside of the U.S. This makes it harder for law enforcement to find and bring them to justice.

The FTC says people lose around $120 million yearly on these and similar scams. Do yourself a favor and steer clear.

10. Fake Customer Scams

While many phone scams focus on individuals, businesses are also at risk. Some phone scams target businesses, seeking to exploit their desire to provide excellent service by pretending to be paying customers.

Of course, the scammers aren’t customers, and they never intend to pay. They commonly claim to be in trouble and ask for money or compensation.

Make sure to verify the customer’s identity before you pay them. If you haven’t interacted with them in a while, consider hanging up and calling the customer directly to confirm their request.

11. Craigslist Verification Scam

This scam is much different than you think, so keep reading. This isn’t the most common phone scam, but it’s more dangerous.

The new Craigslist scam is intended to take over your email accounts using verification codes sent to your phone.

How the scam works is when you respond to an ad, probably for a product that has an exceptionally good price that you have to have. Maybe a brand Samsung phone for $100. When you initiate contact with the anonymous seller, you probably send them an email or a text message.

Instead of interacting with a legitimate seller, the scammer immediately tries to break into your email account, most commonly Google. They will claim that they need to verify your email by typing in a code. Surely, your phone gets notified of your account verification code (which was legitimate), but instead of using it for yourself, you send that to the scammer.

Seconds later, the scammer takes over your email account. They can download your emails in minutes and begin compromising your other accounts with your bank, social media, and everything else. They might even sign in and do nefarious things after you go to bed. Yikes!

12. Coronavirus (COVID-19) Scams (New!)

Even more insidious are the scams preying on the coronavirus pandemic that has taken the world by storm. With no clear path to recovery and empty store shelves, predators are capitalizing this moment. Unsolicited phone calls target people with false promises of cures, test kits, or special serums assuring immunity.

It’s too easy to get lured with a text message, email, Tweet, or phone call. Follow the advice your local public health department and the Center for Disease Control (CDC) posted.

Be alert and check with the FTC for an updated list of financial relief scams.

13. Government Stimulus Check Scams (New!)

Along with the coronavirus pandemic, many Americans share economic anxiety. Many are eager to receive stimulus checks from the U.S. government for their household. What’s not known yet is precisely how the funds will arrive.

Scammers are already on the prowl with fake text messages and robocalls inviting you to “claim” your government benefits or to expedite the checks.

The Federal Trade Commission offers these straightforward tips to combat this common scam:

- The government will not ask you to pay anything upfront to get this money. No fees. No charges. No nothing.

- The government will not call to ask for your Social Security number, bank account, or credit card number. Anyone who does is a scammer.

- These reports of checks aren’t yet a reality. Anyone who tells you they can get you the money now is a scammer.

For official information, go right to the source—not secondhand sources. Follow the updates published by the U.S. Department of Treasury. Until then, block anyone who claims to provide you with a check or a direct deposit into your bank account.

If you received a fraudulent offer in your email or over social media, officials recommend that you report it to the FBI’s Internet Crime Complaint Center.

How to Fight Back Against Phone Scams

With so many phone scams out there, you have to watch out. Smart consumers arm themselves with knowledge and stay vigilant.

Here are helpful tips to fight back against common phone scams.

- Document your interactions. If you get a call, write down their name or facts about the call.

- Google the caller’s phone number. Unfortunately, phone numbers are often spoofed, but sometimes the results on Google come in handy, especially if others complain.

- Activate Scam Blocking/Filtering on your cell phone plan. This feature will significantly reduce the number of robocalls you receive.

- Restrict anonymous callers from calling your business phone system. Tools like anonymous call rejection will thwart many unknown or otherwise “private” callers from targeting your employees.

- Add yourself to the Do Not Call Registry. This will have a limited effect against scams since most calls originate outside the U.S., but telemarketing companies must honor this opt-out request.

- Report a scam if you’re a victim. If you’ve been the victim of a phone scam, you can report it to the FTC. This will help the agency and other law enforcement professionals identify trends and patterns in the industry.

The best offense against a scammer is knowledge and vigilance. Help others out by sharing this article on social media or emailing it to them so they know how to stay safe from scams over the phone.

VoIP

VoIP